Transform Your Finances: Leading Tips for Effective Finance Refinance

Effective car loan refinancing can offer as a crucial technique in transforming your financial landscape. By recognizing the nuances of your present financings and evaluating your credit scores score, you can place yourself to protect much more beneficial terms.

Understand Your Present Fundings

Prior to embarking on the funding re-finance trip, it is important to conduct a comprehensive assessment of your existing fundings. Comprehending the specifics of your existing lendings, consisting of passion prices, terms, and impressive balances, is critical for making notified decisions. Begin by assembling a total checklist of your finances, noting the kind-- be it a mortgage, vehicle financing, or trainee loan-- along with the lender details.

Pay special focus to the rates of interest associated with each finance. High-interest fundings can profit dramatically from refinancing, as protecting a lower price could cause substantial cost savings with time. Additionally, take into consideration the terms of your lendings; those with longer settlement periods may have reduced monthly repayments however can build up more passion over time.

It is likewise crucial to recognize any prepayment charges or costs related to your present financings. These costs can impact the general benefits of refinancing. By very carefully assessing your existing loans, you can figure out whether refinancing lines up with your economic objectives and develop a clear approach for moving ahead in the refinancing process. This fundamental understanding will certainly encourage you to make even more critical and advantageous monetary decisions.

Evaluate Your Credit History

A strong understanding of your credit rating rating is essential when taking into consideration finance refinancing, as it substantially influences the interest prices and terms loan providers want to use. Credit history typically vary from 300 to 850, with higher scores showing much better creditworthiness. Prior to starting the refinancing process, it is important to evaluate your credit rating record for any type of inaccuracies that can negatively influence your score.

If your rating is below the ideal variety (typically taken into consideration to be 700 or above), take into consideration taking steps to enhance it prior to getting refinancing. This might include paying down existing financial debt, making timely repayments, or disputing any mistakes. A greater credit report can lead to a lot more favorable refinancing terms, eventually conserving you cash in the future.

Research Study Refinance Options

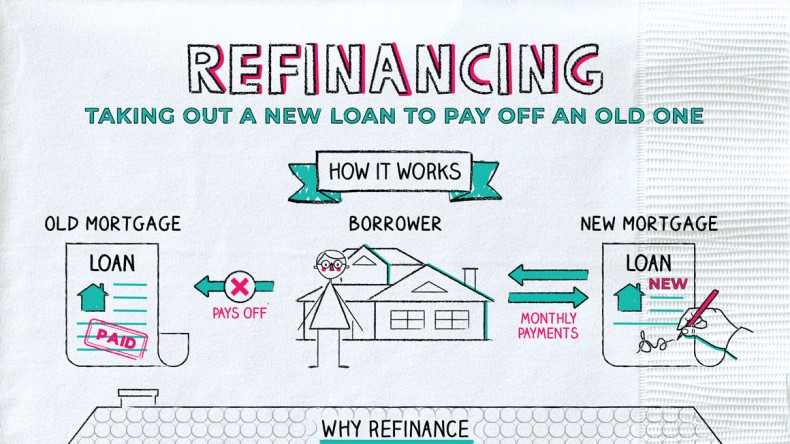

Discovering numerous refinance options is necessary for securing the finest this post feasible terms for why not try here your loan. The market uses a plethora of choices, each tailored to different monetary circumstances and purposes. Begin by assessing the types of refinancing offered, such as rate-and-term refinancing, cash-out refinancing, and simplify refinancing. Each alternative offers distinct purposes, whether you aim to reduce your rate of interest price, accessibility equity, or streamline your existing lending terms.

Following, recognize possible loan providers, consisting of standard banks, credit score unions, and on the internet mortgage companies. Study their offerings, interest rates, and charges, as these can vary considerably. It is essential to read customer testimonials and inspect their track record with governing bodies to determine integrity and consumer solution.

Additionally, consider the lending terms used by various lenders, consisting of the size of the financing, taken care of vs. flexible rates, and connected closing expenses. Collecting this details will certainly encourage you to make informed decisions and work out far better terms.

Finally, be mindful of existing market trends and financial signs, as they can affect rate of interest rates. By completely researching re-finance choices, you place yourself to maximize your monetary end results and accomplish your refinancing objectives efficiently.

Compute Potential Financial Savings

Calculating prospective savings is a crucial action in the refinancing process, enabling borrowers to examine whether the advantages outweigh the expenses. To start, identify your present loan terms, including rate of interest, regular monthly settlement, and remaining balance. Next off, get quotes for new finance terms from various lenders to contrast passion prices and associated charges.

As soon as you have this details, use a finance calculator to approximate your new regular monthly repayment based upon the recommended interest rate and car loan quantity. Deduct this why not look here number from your existing monthly settlement to establish your prospective cost savings monthly.

Don't fail to remember to consider any kind of closing costs connected with refinancing, as these can considerably affect your overall cost savings. By extensively determining both month-to-month and lasting financial savings, you can make an informed decision on whether refinancing is a financially useful relocation for your circumstance.

Prepare Essential Paperwork

Having actually analyzed possible financial savings, the following action in the refinancing process involves gathering the necessary documentation to promote a smooth application. An efficient collection of records not only accelerates the authorization process but also boosts your credibility as a consumer.

Lenders will need proof of revenue to assess your ability to pay off the funding. Additionally, collect your bank declarations and any financial investment account information, as they provide understanding into your monetary health.

Last but not least, be prepared to give identification records, such as a chauffeur's certificate or copyright. Complete prep work of these materials can substantially streamline the refinancing process, making it extra efficient and much less stressful for you.

Conclusion

In verdict, efficient finance refinancing demands a thorough strategy that consists of comprehending existing finances, examining credit reliability, checking out different refinancing options, and calculating possible financial savings. Cautious consideration and strategic planning are paramount to successful lending refinancing ventures.

Comments on “USDA loan refinance: Enjoy Lower Payments Without Hassle.”